In an increasingly digitized world, every industry faces the challenge of meeting heightened consumer expectations. The mortgage sector is no different. While many digital mortgage companies are using a patchwork of different tech tools to enhance the borrower experience, this can lead to disjointed processes and communication gaps. However, a groundbreaking shift is on the horizon, with the advent of the Mortgage Experience Platform.

The Problem with Patchwork:

Traditional digital mortgage processes are often akin to a quilt of various technologies. Each piece, or technology, might be excellent on its own, but when stitched together, the experience can become clunky. This approach can lead to inefficiencies, from redundant data entry to disjointed communication.

The Seamless Solution - Mortgage Experience Platform:

Rather than trying to stitch together multiple tech solutions, the Mortgage Experience Platform offers an integrated approach. It's a holistic tool designed to handle every phase of the mortgage journey, from application to closing, in one unified space. Borrowers can smoothly transition from one step to the next, without having to grapple with different interfaces or repeat tasks.

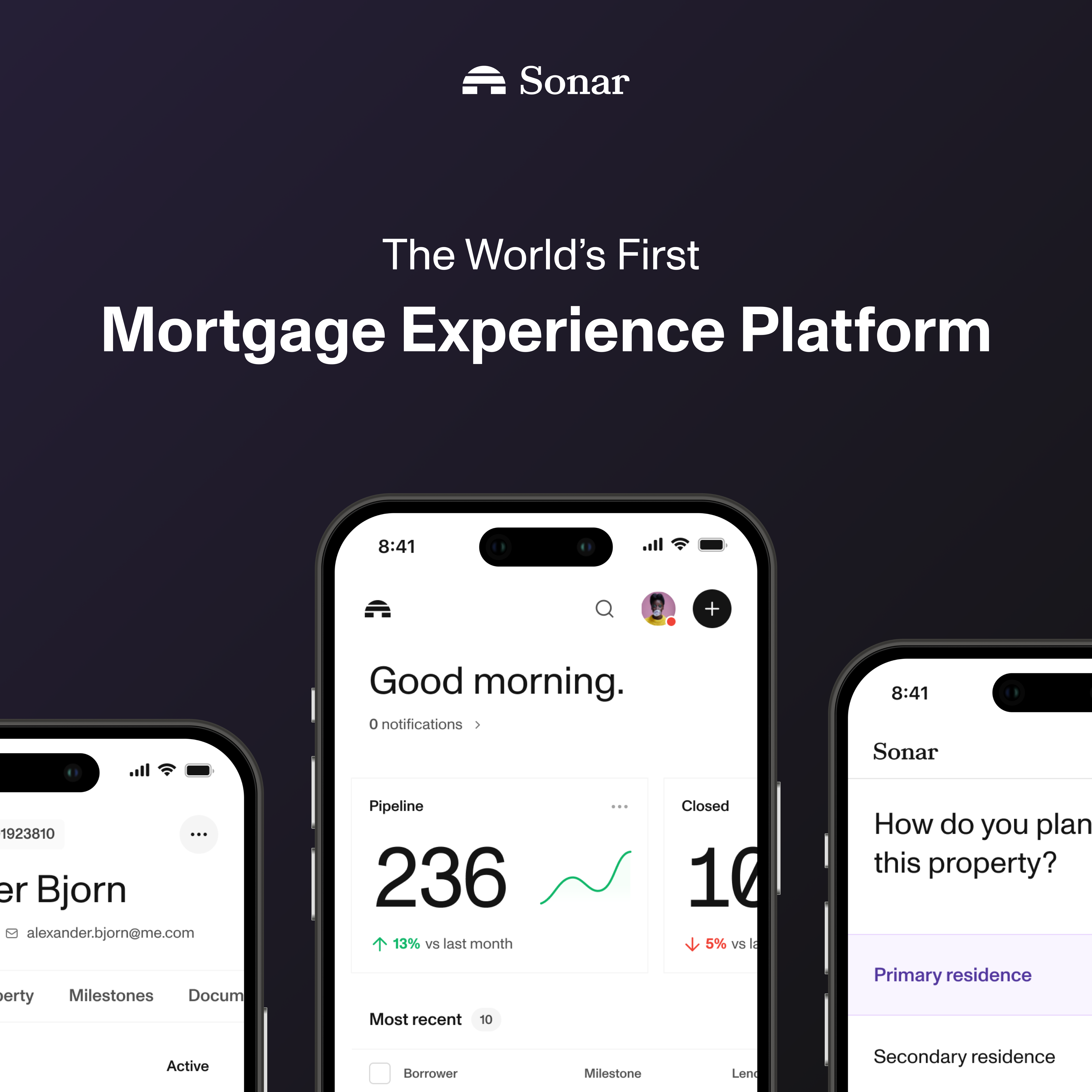

Introducing Sonar:

This is where Sonar comes into play. As a pioneering Mortgage Experience Platform, Sonar is setting new industry standards. By powering the entire mortgage process seamlessly, Sonar eliminates the fragmentation that can occur when using multiple mortgage software systems. This comprehensive tool ensures that borrowers get a truly streamlined experience.

Why Simplist Chooses Sonar:

Simplist, always committed to delivering the best to its consumers, recognized the unmatched potential of Sonar. Instead of juggling various tech tools, Simplist employs Sonar to ensure a unified, smooth, and efficient mortgage journey for its users.

In Conclusion:

In the evolving landscape of digital mortgages, it's no longer enough to simply be online. The experience must be cohesive, intuitive, and efficient. While many companies scramble to piece together tech solutions, forward-thinking entities like Simplist are looking to comprehensive tools like the Mortgage Experience Platform. By embracing Sonar, Simplist isn't just keeping up with the times; it's leading the way.

But the benefits don’t stop at the improved user experience. Sonar’s integrated solution is proving to be more than just a tool for operational efficiency. By consolidating the mortgage process into one platform, we're seeing a marked reduction in our overall tech costs. This efficiency is a win-win situation. Not only does it streamline operations from our end, but it also means we can pass on those savings directly to our valued customers, ensuring that they get hyper competitive mortgage rates and a process that's both fast and affordable.

The future of the mortgage industry is not just about digitization, but about smart, holistic solutions that benefit both companies and consumers. And with platforms like Sonar at the helm, that future looks brighter than ever.

At Simplist, creating better customer experience is our number one priority. That’s why we use only the most advanced technology in the industry. In addition, you’ll have a dedicated loan expert as your point of contact, so that you always have someone to ask when you need clarification or confirmation. Ready to get started? Get pre-approved or begin the process of applying for your mortgage or refinance.