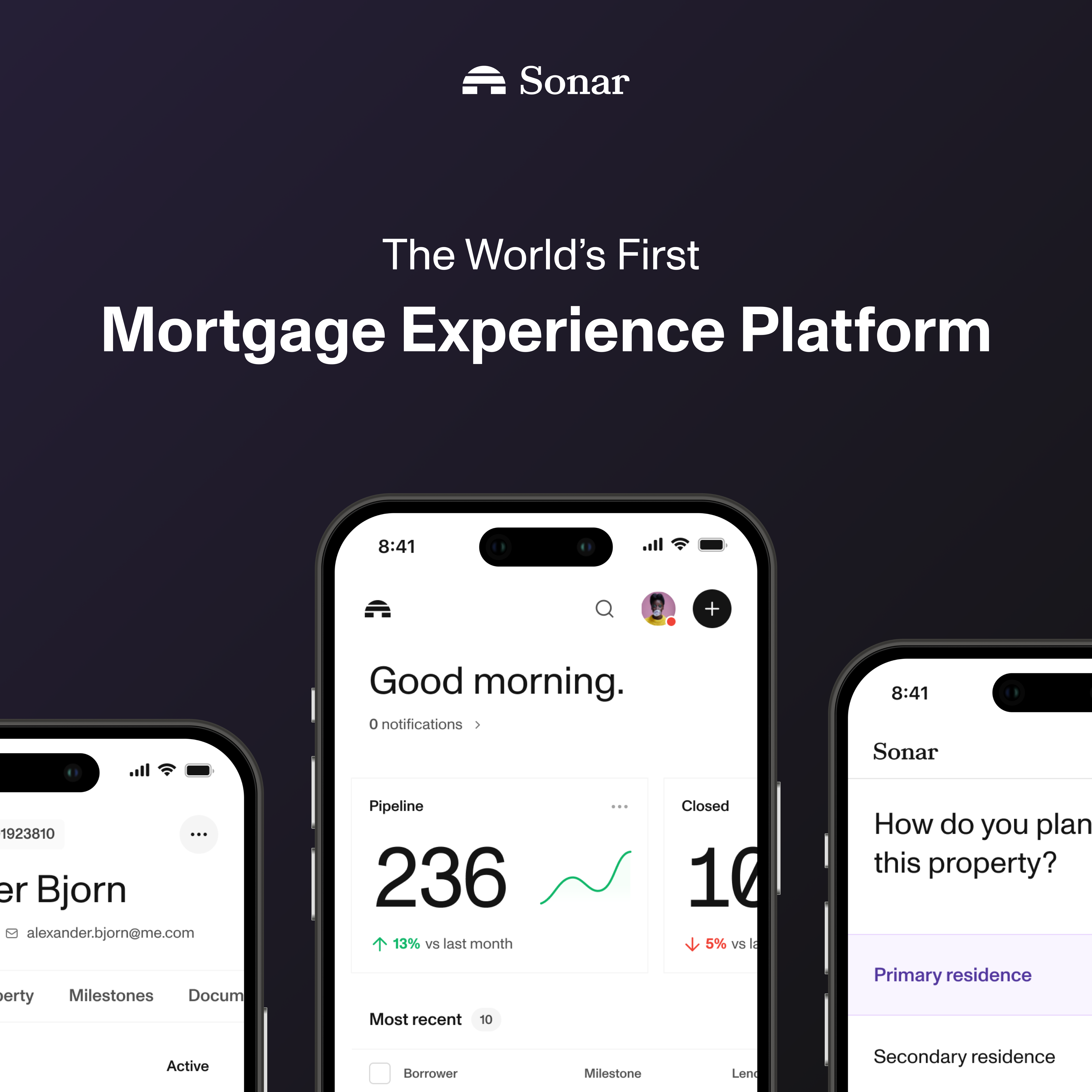

Why the Mortgage Experience Platform is a Game-Changer in Digital Mortgages

In an increasingly digitized world, every industry faces the challenge of meeting heightened consumer expectations. The mortgage sector is no different. While many digital mortgage companies are using a patchwork of different tech tools to enhance the borrower experience, this can lead to disjointed processes and communication gaps.